Woman, are you kindling the idea of starting your business? Planning on picking up small business loans? The hurdle perhaps is the confusion because of the plethora of business loans for women, right?

Well, this blog post will give you a gist of all the available business loans for women. For each and every woman dreaming of starting her own business, this article will simplify the process of how to get a business loan.

Let’s take a look at some of the most popular small business loans available for women entrepreneurs.

6 Popular Business Loan Options Available For Women Entrepreneurs

1. Stree Shakti Package

Empower your business with the Stree Shakti Package started by State Bank of India. If you have more than 50% of women shareholders in your company, this loan is for you. You get many concessions under this scheme. You have an advantage of lower rates of interest (in case the loan is not more than Rs 2 lakh). And you don’t need collateral security to get this loan. This scheme gives you a loan of up to 5 lakh rupees.

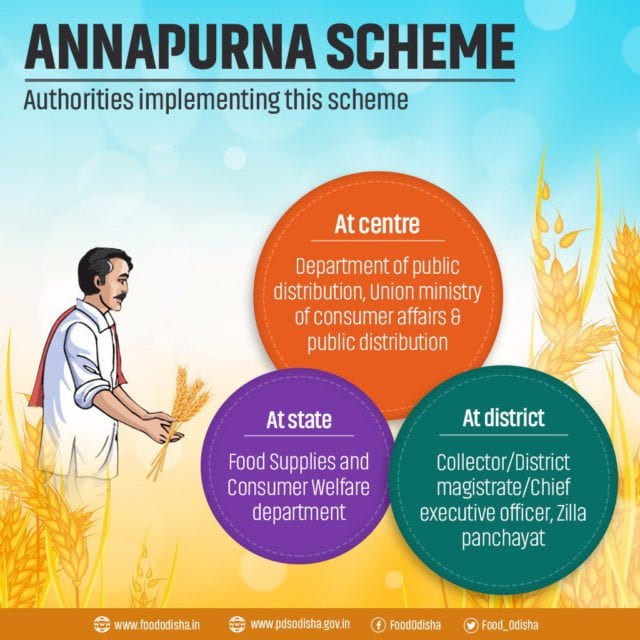

2. Annapurna Scheme

If you require funds for the short term, then check out the Annapurna Scheme. It gives you a loan of up to 50,000 rupees. The state bank of Mysore and Bharatiya Mahila Bank provide this loan. Payback is in the form of EMI. And you can pay back within 36 months along with interest. This loan requires collateral security and the signatures of a guarantor, so be armed.

3. Cent-Kalyani Scheme

The Cent-Kalyani Scheme is best if you have an existing business or you are starting a business like food delivery, parlour or catering. This loan is given by the Central Bank of India. It is specifically for women entrepreneurs having an MSME (Micro, small, medium enterprises) business. It is best suited if your loan requirement is as high as 1 crore. The margin rate is 20 percent and the interest is set as per the market rates. To get this business loan, you don’t need any guarantor or collateral security.

4. Bhartiya Mahila Bank Business Loan

If your business belongs to retail and MSME industries and your loan requirement is high, then you need to check out the Bharatiya Mahila Bank business loan. Bharatiya Mahila Bank provides a startup business loan up to 1 crore rupees for the retail sector and up to 5 crore rupees for the manufacturing and service industry. The loan amount can go up to 20 crore rupees. You will have to pay an interest rate of 10.15% or high in this scheme. The sole requirement to get this loan is to have at least 2 years of work experience and a take-home income of over 25,000 rupees.

5. Dena Shakti Scheme

For fuelling your short-term needs, the Dena Shakti Scheme is a great option. This loan is extended by Dena Bank to the women operating in the retail, manufacturing, education and MSME sectors. The loan amount is up to Rs 20 lakh for retail, education and housing sector; and up to Rs 50,000 for micro-credit. The rate of interest for this one is as per the directives of the RBI and the guidelines of the bank.

6. Mudra Yojana Scheme For Women

Mudra Yojana Scheme for women is the most popular and sought after scheme. Pick up a loan of up to Rs 10 lakh (maximum) and Rs 50,000 (minimum) under this scheme. This one too has no hassles of collateral security. But you should fit the eligibility criteria set by the government to get this loan. It is sanctioned by all banks. The rate of interest varies from bank to bank.

7. Orient Mahila Vikas Yojana Scheme

Orient Mahila Vikas Yojana Scheme is a business loan for women sanctioned by Oriental Bank of Commerce. You get a loan of up to 25 lakh rupees under this scheme. It doesn’t require collateral security and the payback period is 7 years. The only catch here is that your company should have over 50% of women shareholders.

How Do You Apply For A Business Loan?

And now that you have understood the types of loans for women entrepreneurs, let us quickly understand how to get a business loan. You certainly have a whole lot of paperwork but also there is a process for loan application.

Only keep in mind these things –

- Submit all the necessary documents – personal as well as professional – like PAN card, Aadhar card, address proof, and all other related documents.

- Draft a letter that states the nature of your business, a detailed business plan, how and where you will use the loan amount, objectives and goals of your business, details about the avenues for return of investment and growth of the business.

- Pick a loan that fits your business requirement and the nature of your business.

- Pick a loan that has an affordable rate of interest and generous payback time.

These small business loans are a blessing to women entrepreneurs. These loans can be customised and get sanctioned within a week or so. Adding a few extra pennies to your business helps you with infrastructure, expansion of operation and upgrading the business plants, machinery, maintaining inventory and what not. Customise these loans to fit your business model and see your business grow two-fold. But the fact remains that women entrepreneurs in India face much more than just a sound understanding of how to get a business loan.

Challenges faced by aspiring women entrepreneurs are many Stiff competition, lack of finance is a part of the process. But lack of family support, living in a male-dominated society, low-risk bearing capacity are some of the other challenges. Financial literacy is another huge hurdle. Moreover, an outgoing woman in India is often scorned upon. Their mobility and risk-taking abilities are questioned. How do you overcome these demotivating factors? By standing strong and fighting back. Fighting for your aspirations and dreams is in your hands. So, take startup business loans and give wings to your dreams. Why stay back when you can leave your imprints now!

FAQs – Frequently Asked Questions

Q. What is the maximum and the minimum limit of a small business loan?

A. Small business loans are picked from time to time. The minimum amount can be anywhere between 10 to 50 thousand and the maximum is 20 crores as per the schemes mentioned above.

Q. Who all can get a business loan?

A. Anybody can avail of the business loans for their business. Any upcoming business or existing business owner can apply for business loans. However, the above-mentioned business loans are for women.

Q. How much time does it take for the loan to be sanctioned?

A. Ideally, a loan for women to commence business is sanctioned within a week. But sanctioning of the loan also depends on the loan amount. A loan with a big amount takes more time to process.